Summary:

The Victorian Government is implementing a historic change that replaces stamp duty on commercial and industrial properties with a more effective Commercial and Industrial Property Tax to encourage businesses to invest, develop, and grow.

In May 2024, the Royal Assent ratified the Commercial and Industrial Property Tax Reform Act 2024.

A new property tax system will be in effect for commercial and industrial property purchases made in Victoria as of July 1, 2024.

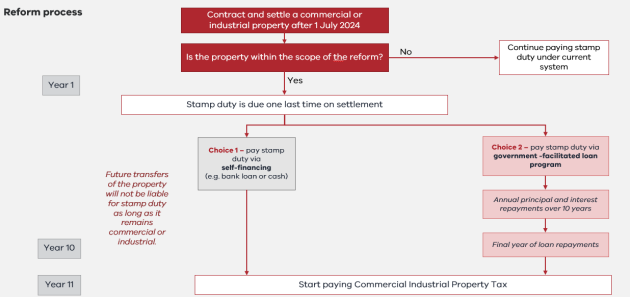

Stamp duty will be paid once on the property if and when it is transacted, and the new annual Commercial and Industrial Property Tax will be payable ten years after the final stamp duty payment for commercial and industrial property transactions with both a contract and settlement date on or after July 1, 2024.

The option to apply for a government transition loan—which Treasury Corporation Victoria will provide—would enable qualifying buyers to manage the switch to annual property taxes and settle any outstanding upfront stamp duty costs related to their purchase.

Our previous Property Tax article can be accessed here.

What is reform?

The Victorian government is gradually doing away with stamp duty on commercial and industrial property, as stated in the 2023–24 Budget. In its place will be a more effective yearly tax known as the “Commercial and Industrial Property Tax,” which would be based on the value of unimproved land.

In June 2023, an information sheet detailing the reform’s planned policy goals was made available. It also included a promise to conduct focused consultation to gather input for the creation of the final design and transition plans.

The government’s focused consultation with business and industry leaders on the specifics of this reform is now concluded.

Additional information on the reform and transition arrangements’ design, which was influenced by this consultation, is provided in this information document.

Reform Design Features

Commercial and industrial property transactions with a contract and settlement date on or after July 1, 2024, will be subject to the new tax regime. The new annual Commercial and Industrial Property Tax will be due ten years after the latest stamp duty payment, regardless of whether the property has been transacted again. For these properties, stamp duty will be paid once, if and when it is transacted.

If a property is utilised for business and industrial purposes, stamp duty won’t be charged if it is sold again.

Without complex rate schedules or thresholds, the Commercial and Industrial Property Tax will be set at a flat 1% of the property’s unimproved land value.

Reforms won’t apply to:

Real estate, either commercial or industrial, acquired before July 1, 2024

Properties categorised by the Valuer-General as being principally utilised for residential, primary production, community services, sport, or history and culture reasons.

Reform Process

What Property Will Attract CIPT?

Certain properties used for student housing and any Victorian real estate with a qualified commercial or industrial use would be subject to the CIPT. The Australian Valuation Property Classification Code ranges from 200–499 or 600–699 provides the list of eligible uses.

The CIPT will not apply to residential, primary production, community services, sporting, historical, or cultural assets under the present version of the bill.

When is CIPT payable on a property?

The CIP Tax regime will apply to land when:

- There is a qualified landholder transaction or qualifying dutiable transaction involving the land;

- When specific kinds of subdivision (of property that is already governed by the system) take place; and

- When territory that is already under the rule is consolidated.

Additionally, the interest in the property must be 50% or more and qualify as an interest (such as a tenant in common with a 50% interest in the land, life estates, estates in fee simple, and Crown leasehold).

Owners of existing commercial or industrial property with a qualifying use will not be subject to the new regime or CIP Tax until the property is sold after July 1, 2024, or until a relevant subdivision or consolidation takes place.

How is the Commercial and Industrial Property Tax Paid?

Land buyers who purchase under the new system will be responsible for paying duty on the transaction that brings the property under the new regime. Buyers can choose to pay the levy or apply for a “transition loan,” which is provided on a commercial basis by the government.

Following a 10-year transitional period from the date the land entered the system, the land will be subject to CIP Tax. In addition to property tax, windfall gains tax, and local government rates, charges, and levies, this tax is distinct. The responsibility is computed in addition to the standard surcharges for absentee owners or trusts.

Every calendar year, starting at midnight on December 31 of the year before the tax year, CIP Tax will be levied. The CIP Tax is due on:

- Land under the CIP system;

- Land beyond the 10-year transition period mentioned above;

- Land having the previously mentioned qualifying use; and

- Land lacking any exemption under the Land Tax Act

The amount of CIP tax due will be determined by taking 1% of the land’s site value—the same taxable value as land tax. The CIP Tax rate on build-to-rent property is 0.5%, not 1%.

Can the amount owed on CIP taxes be transferred to renters or modified at settlement?

Commercial property owners may be entitled to pass on their tenants’ CIP Tax duty as an expenditure, according to the conditions of the lease. It appears that landlords of retail properties will not be permitted to charge renters CIP Tax under the Retail Leases Act, however, we are still awaiting clarification from the law.

Due to the current legislative ban on obligation adjustment under the Land Tax Act, CIP Tax liability cannot be adjusted between a vendor and a purchaser at settlement.

The Victoria Parliament still needs to approve the legal changes that the Bill proposes, however the foregoing is an overview of the main points to remember.

Annual Property Tax After The 10 Year Transition Period

The property owner will be responsible for paying the new tax following the 10-year transition period. This tax is levied in addition to any land tax and is computed at 1% per year of the land’s unimproved value. The new charge, like land tax, cannot be imposed on retail tenants.

Impact on SMSFs

Trustees of self-managed superannuation funds (SMSFs) that make investments in C&I Property starting on July 1, 2024, must understand the details of this new tax. This comprises:

- The SMSF trustee will have to pay the duty in full as a Victim if the property has not yet entered the 10-year transition period and the SMSF is buying the property outright (i.e., without financing). Borrowing a loan will probably result in a charge being levied on the property against the regulations. 13.14 The Superannuation Sector.

- If the property has entered the 10-year transition period, the trustee of the SMSF should know if the property still has a “free kick” time left on it.

- The SMSF trustee will be required to pay the new 1% annual tax on the property’s unimproved value once the 10-year transition period has passed.

Final Stamp Duty Liability Payment

The first person to acquire a Relevant Property on or after July 1, 2024, will usually be responsible for paying the property’s final stamp duty obligation.

Buyers who meet the requirements might choose to pay in full now or over ten years using a government-facilitated loan (Transition Loan).

Although the qualifying requirements for Transition Loans have not yet been established, it is anticipated that this facility will only be accessible to:

- Individuals who do not fall within the criteria of a foreign entity, as well.

- Assets that are being purchased for less than $30 million.

Landholder Duty On First Transaction On Or After 1 July 2024

A change might be sparked by more than simply straight land transfers. A transition may also be started by a “qualifying landholder transaction.”

A “qualifying landholder transaction” is defined as:

- The deal represents a pertinent acquisition for a landowner;

- The landholder possesses freehold interests in the land at the time of the relevant acquisition

- The applicable purchase is subject to duty; and

- A company consolidation concession or a corporate reconstruction concession is not available for the applicable purchase.

In general, if the landholder transacts 50% or more of the interest in the underlying landholdings, the landholdings will be considered to enter the CIPT regime.

There are regulations requiring the accumulation of interests within a three-year timeframe.

Tax Rate

To comply with land tax laws, the taxable value of the land—typically the site value—will be the fixed rate of 1% for the CIPT. Land that is qualified for a BTR benefit under the Land Tax Act of 2005 is subject to a concessional rate of 0.5%.

Foreign proprietors are accountable for CIPT. On CIPT, there isn’t an absentee surcharge.

The current land tax system is supplemented by the independent CIPT.

Subsequent Sales

According to earlier guidelines, land transfer duty would not be applied if a property was sold after it had joined the CIPT regime as long as it was still being used for commercial and industrial purposes.

The regime outlined earlier is not the same as what is contained in the Bill.

In general, the Bill’s provisions have the following effects:

- Any subsequent transaction during the 10-year transition period will not be subject to duty if a 100% stake in the property has been traded on or after July 1, 2024; and

- If a transaction on a different interest in the land is made on or after July 1, 2024, and less than 100% of the land has been transacted (but at least 50% has been transacted, making the property subject to the CIPT regime), there may be a land transfer duty charge under the current provisions for three years, or until the land has been fully assessed, whichever comes first. This is new; earlier instructions did not address the three-year term.

Classification Of Property

A property is deemed to have a qualified use if one of the following occurs:

- The land is assigned an Australian Valuation Property Classification Code that corresponds to land used for infrastructure and utilities, commercial, industrial, or extractive enterprises;

- The building meets the requirements for student housing.

A sole or principal use test will be used to decide how the property is treated for mixed-use properties. The whole mixed-use property will be subject to CIPT if the results of the single or principal-use test show that the property meets the requirements.

Changes In Use

When a property is first transferred on or after July 1, 2024, it will be decided if it has a qualifying purpose. Usually, this will be the settlement date.

The owner of a property that joins the CIPT regime but later loses its qualifying use is not responsible for paying CIPT. Each year on December 31st, the usage of the land determines liability for CIPT. This corresponds to the land tax obligation date.

The current duty regulations will be in effect if a property is sold while it is being used for a non-qualifying purpose.

A “change of use duty” will be incurred if a property that has been brought under the CIPT system is subsequently converted to a non-qualifying use after being transacted with again for a qualifying use and duty has not been paid on that transaction.

The duty that would have been due at the time the property was transferred, less 10% for each calendar year that has elapsed since then, shall be the basis for calculating the change in use duty.

There is no change of use duty refund if the property is converted to a non-qualifying use and then back to a qualifying use.

If a property owner changes how a property is used, they must tell the SRO within thirty days.

Exceptions

No one is exempt from the new tax:

- Property held by C&I before July 1, 2024.

- Residential real estate.

- Land that is mostly utilised for primary production.

Planning

Expert advice should be sought if a transfer or sale of C&I property is being considered shortly, since the property’s value may be affected by this new tax. If you’re considering restructuring or moving to a related party, you should look at the benefits and drawbacks of moving before June 30, 2024, vs later.

Recovery

Land for which CIPT is owed is initially charged with unpaid CIPT, including interest and penalty tax.

The Commissioner may demand payment of the outstanding CIPT (including interest and penalty tax) from a lessee, mortgagee, or occupier of the land on which the CIPT is payable in the event of a tax delinquency about CIPT.

Lessees and occupiers are not allowed to be obliged to pay the Commissioner more rent than what they are obligated to pay the taxpayer (landowner). A lessee or occupier who is a linked corporation or a taxpayer’s relative, however, is exempt from this. This is similar to the Land Tax Act of 2005’s current regulations regarding land tax collection.

Takeaway

Clients wishing to make a long-term investment in commercial or industrial property should seriously consider completing the acquisition before July 1, 2024, as that is the date on which CIPT will begin. A heads of agreement or similar document completed before July 1, 2024, may be enough to prevent the transaction from being an entry transaction that results in the land entering the CIPT regime, rather than the land needing to be transferred before then.

The chance to obtain a government-facilitated loan to settle their duty obligation over ten years may be advantageous from a cash flow standpoint for customers seeking to make short-term investments. The Treasurer will decide the qualifying requirements for the government-facilitated loan; they have not yet been made public. Customers falling within such a group ought to keep an eye out for the government’s announcement.

A two-tier market for pertinent properties that emerges between the time the land enters the CIPT regime and the date the first CIPT liability becomes payable is probably going to be created by the structure of the CIPT regime. This might provide problems for vendors competing with other sellers who have land with a different duty profile, as well as possibilities for buyers. Properties that have joined the CIPT regime are likely to be more attractive to potential buyers because they do not have to pay stamp duty or at a reduced rate.