Businesses are increasingly choosing to outsource their bookkeeping and accounting over time. As the benefits increase, its prevalence rises. We’ll talk about outsourced accounting in this article and how it can benefit you.

Your business is growing and you’ve worked hard to get it that way, but right now you’re confused by payroll, tax deadlines, invoices, receipts, and spreadsheets.

Many businesses outsource their accounting responsibilities. Professionals maximise cash flow, cut down on overall processing time, and identify the most and least profitable product lines. Why don’t you pursue it then?

Outsourcing your bookkeeping and accounting tasks to someone who can focus on product/service development and marketing is a logical decision.

But is it worth the work for your business to use external accounting services?

Let’s dive deep in the sea of outsourcing accounting services.

What is Outsourced Accounting?

Outsource accounting is having an external accounting department to manage your in-house accounting needs.

Think of an accounting firm as a team member that is added to your own. It offers routine accounting services, such as:

- Payroll Processing

- Bill Payment

- Sales Invoicing

- Transaction Processing

- Financial Reporting

but at a lower cost and with economies of scale that are challenging to attain with in-house accounting teams.

An outsourced accounting organisation provides financial knowledge, scalability, and efficiency. As a business owner, you can concentrate on expanding your company while making data-driven decisions.

Process of Outsourcing in Accounting

An outsourced services provider will start by examining your requirements and determining how to help you achieve your goals. After evaluating your requirements, they will provide a proposal outlining the services they can offer and the associated expenses.

You may encounter situations in which new systems or business apps are introduced to improve your operations and give better data. The other times accounting procedures are required to increase internal control.

Benefits of Outsourcing Accounting

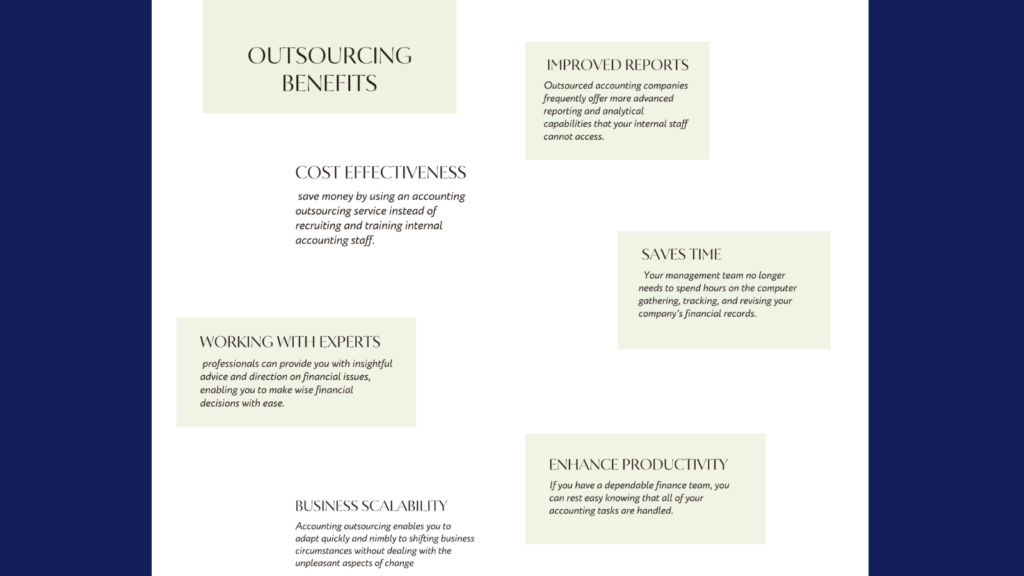

When you outsource your accounting function, your business operations will be optimised and profits will be maximised. However, some organisations are apprehensive about giving up control over such a critical component of their operations. Outsourcing can bring a multitude of benefits, including cost reductions and enhanced financial reporting. Some reasons that you should opt for outsourced accounting services:

Cost Effectiveness

Solutions for business accounting are less expensive than recruiting staff members for internal use. You can save money by using an accounting outsourcing service instead of recruiting and training internal accounting staff. This also helps to lower the purchasing and maintaining of the accounting software and hardware.

It’s possible to pay for the services you require through outsourcing, so what more could you want? As a result, you can put money aside for other company needs.

Working with Experts

Without a group of professionals handling your accounting, you wind up doing a lot of trial and error.

Working with an outsourced accounting firm gives you access to work with extremely knowledgeable and experienced individuals with a focus on financial accounting.

These professionals can provide you with insightful advice and direction on financial issues, enabling you to make wise financial decisions with ease.

Business Scalability

You may scale up or down your accounting services based on your business’s demands when you outsource them. Without worrying about workforce shortages, you can change your accounting services accordingly.

Accounting outsourcing enables you to adapt quickly and nimbly to shifting business circumstances without dealing with the unpleasant aspects of change.

Improved Reports

Outsourced accounting companies frequently offer more advanced reporting and analytical capabilities that your internal staff cannot access. Your company can benefit from real-time data and insights if you outsource.

Fraud and mistakes can be reduced by hiring a qualified accounting team. Proowrx is a professional accounting firm with tight controls and procedures that ensure accurate financial reporting and regulatory compliance.

Saves Time

Outsourcing your accounting activities allows your in-house team to focus on key business operations. Your management team no longer needs to spend hours on the computer gathering, tracking, and revising your company’s financial records.

The benefit of saving time can be used to expand your business and provide value to your consumers.

Enhance productivity

If you have a dependable finance team, you can rest easy knowing that all of your accounting tasks are handled. You will also gain valuable financial reporting insights on your company’s performance, cash flow, planning, and more.

Outsourced Accounting Benefits Who?

Traditionally, only major corporations used outsourced accounting services. With technological developments and increased familiarity with remote workers, it is now available to smaller firms and organisations. Outsourced accounting services are suitable for:

Small businesses

A small business owner who does not require a full-time accountant or chief financial officer (CFO), but does require someone with greater abilities.

A company struggling to hire

A company of any size, having difficulty finding a suitable and inexpensive full-time employee. Also, every time your accountant departs, you must hire, train, and hope they work; outsourcing to a team of accountants eliminates this issue.

Growing companies

An emerging or growing company that wants to scale up its accounting or financial abilities

Non Profit Organisation

Breakthrough has extensive experience in non-profit accounting, including managing donations and tax-deductible receipts, recording and acquiring programmes, managing grant funding, and fulfilling annual reporting duties to various regulatory bodies.

Who needs temporary help?

Some businesses and firms need to outsource their accounting for temporary time.

Overall Anyone!!!

Outsourcing is a terrific choice for anyone – whether you have 5 or 500 employees, all businesses have compliance, payroll, and reporting needs. The sooner you start, the faster you’ll see results!

Whether you have 5 or 500 employees, you will have identical requirements.

If you want to know more, please contact our team, and we will help you plan whatever you need.

Factors To Consider Before Outsourcing Accounting

Finding an outsourcing company that meets your needs and requirements is the next step after deciding to outsource. The company must align with your goals and objectives.

While outsourcing and accounting services, we believe that efficiency and quality should come first. There are a few more crucial factors to take into account, though.

Defining Business Needs and Scope

When selecting an outsourcing accounting company, you should be very clear and precise about the demands and expectations of your organisation.

Look at your present list of constraints and accounting systems first. Next, talk with the outsourcing company about the extent of the work.

Poor scope specification and a lack of clarity caused the majority of outsourcing services to fail.

Cost Effectiveness

Each accounting company has a different payment schedule; some bill by the hour, while others send statements monthly. Consequently, you are free to select the payment period that best suits your needs and financial situation. Don’t base your decision solely on affordability.

Expert & Professional Knowledge

Verify that the company you are thinking about hiring has the required training, experience, and credentials.

Keep in mind that you may always look for recommendations from previous or existing customers. Their capacity to deliver results that are consistently high-quality.

Mistakes to avoid while outsourcing

Most of the firms make these common mistakes while outsourcing their accounting.

Outsourcing to the wrong firm

When you partner with an outsourcing firm it is important to share the similar values. This is where you can make a difference: their values, principles, and vision should coincide with you and your business.

Selecting the less knowledgeable firm

It goes without saying that if you are not an expert in accounting, you may or may not be aware of the necessary bookkeeping procedures. A specialist will intervene in this situation. They won’t be of assistance to you if you outsource it to a company that knows less about your sector or your requirements.

Working with a firm that is well-versed in your industry and capable of conducting comprehensive research on a range of topics is wise.

How to pick the best outsourcing accounting firm?

If you want someone that you can rely on every day and are willing to spend a bit more, opt for the best outsourcing firm. But how will you pick the right firm?

Step 1: Pick Industry Players

Since not all companies have the same level of industry experience, you must ascertain what kind of accounting knowledge and skills you require.

Therefore, while choosing the best accounting service provider for your business, it’s crucial to ask the pertinent industry-specific questions.

Step 2: Trust

Find a reliable partner to help you prevent accountant fraud. You should look for a reputable organisation because they have access to private financial data about your company.

Therefore, confirming their credentials and certifications is a great approach to narrowing down the organisations you are thinking about. To find out more about the business, you can also look through their most recent case studies.

Step 3: Price

A monthly fee or an hourly rate may be charged by an accounting firm. The cost will be determined by how long it takes someone to complete your accounting task. Verify that the cost is reasonable.

Step 4: Flexibility

Companies can expand and scale their operations quickly. Your accounting outsourcing partner should be able to assign additional accountants to handle your job in these situations.

Examine the suppliers’ degree of flexibility before deciding to outsource accounting.

Manage your accounting with Proowrx

Want to work with the greatest, be surrounded by the top accounting experts, and be able to depend on security that doesn’t break the bank?

Proowrx understands that hiring in-house accountants can be expensive.

However, what if there was an intelligent, all-in-one programme for managing expenses that were in place, integrated with other accounting software, and offered real-time visibility? And this is all within your budget?

We want your bookkeeping, payroll processing, tax payments, and financial reporting to be organised.

To achieve the greatest outcomes, Proowrx combines our comprehension of your needs with your goals.

Our staff of skilled accountants can take care of your back-office duties with accuracy and efficiency, giving you more time to concentrate on developing long-lasting client connections and expanding your business.